Financing solar can be complex, finicky, and hard to explain. Solargraf makes it easy for you and your customers.

Many solar projects can only happen with financing since a tiny percentage of customers will have the ability to pay upfront. Financing can play a crucial role in loosening up your cash flow and avoiding unnecessary delays associated with materials, labor, and other costs. Here are three ways you can leverage solar financing to boost your sales.

1. Partner with financial institutions – There are lots of them!

There are many types of financing options available, from loans or leases to power purchase agreements (PPAs). The important thing is that more financial institutions can offer you some or all of these solutions. It can be as small as your local bank or can be a sizeable solar originator.

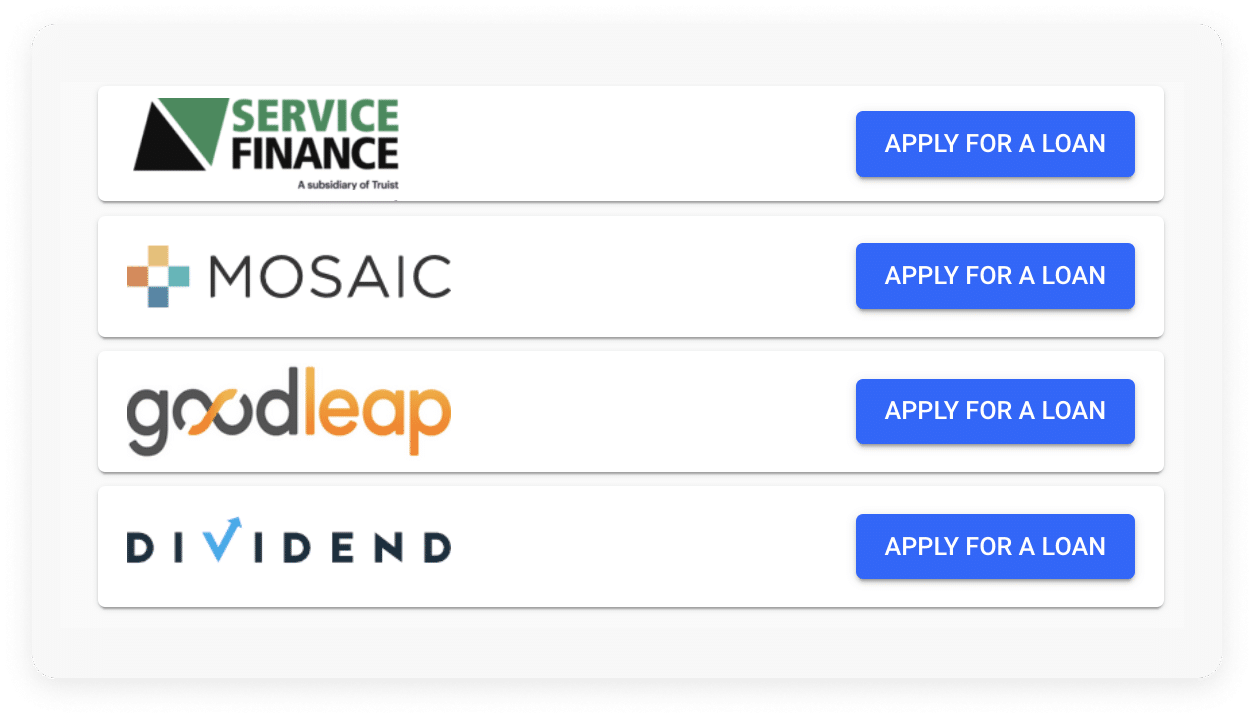

Banks and financial institutions increasingly have created digital platforms that connect directly to your solar CRM and allow you to track and apply for financing in just a few clicks. Solargraf has partnered with primary solar financial originators to make this process straightforward and as easy as a few clicks.

Do you have a favored financing solution? Through a local bank or your platform? Solargraf also allows you to customize financing options to choose the best financing solution for your customers. You can customize each project’s interest rates, tenors, and non-payment periods. You can show prospective customers how their options might pan out in real time and help them feel confident and informed enough to leap.

2. What is the goal of the customer to go solar – Ask questions!

Customers may be motivated by a variety of factors to want solar. Find out what they are, and we can help you get the sale over the line. Customers can be motivated by going green, having a cheaper electricity bill, saving money and time for a return on their investment, or having certainty in future payments. Figuring out what your customer is most interested in is vital to getting them to understand how financing can help achieve those goals.

3. Each customer is unique. Understand their situation to make sure they make the right decision about financing

Not all customers are the same, which means not all customers require the same financing solution. Here are some questions to ask:

- Do you want to own your own system?

- Loans allow customers to own the system immediately. Ownership also means any maintenance is the customers’ responsibility.

- The lease provider owns leases, but the lease provider typically handles any issues with your system.

- Do you want certainty in future solar payments vs utility rates?nc

- Loans in solar are typically fixed rate, which means they have the same monthly payment every month for the life of the loan – check with your financial provider to see if you have a fixed rate or floating rate loan.

- Leases can also have certainty in their payments, but some leases have annual escalators built in –these escalators are typically lower than the inflation of your utility bill.

- Are you eligible for federal, state, or local incentives?

- Typically, you must own your system to be eligible for these benefits, meaning loans may be most suited.

- The Federal ITC (Investment Tax Credit) received when you file your taxes will be a tax benefit but will offset your tax liability first.

- Leases will typically have your lease providers pass on these benefits to lower the monthly payments so you can get some of the benefits without the hassle of filing for these benefits.

- Are you selling your home soon?

- Solar is known to increase the value of your home, so a shorter-term lease or loan is best suited here.

- Are you comfortable with putting your home or solar system up for collateral?

- Typically, solar loans put a lien on the asset to provide you with a loan. Be sure to check with your financial provider for details of this.

United States

United States Germany/Austria

Germany/Austria Brazil

Brazil Netherlands

Netherlands Japan

Japan